Content

If, after paying any installment of estimated tax, the taxpayer determines that a new estimate is required, the payment amounts for the remaining installments may be increased or decreased, as the case may be. Adjusted gross income access to free, name-brand tax-prep software. Anybody — even people above the income threshold — can use Free File to file an extension online. Read our full list of federal income tax deadlines. An extension to file cannot exceed 6 months and does not extend the date for paying the tax.

You can e-file Form 4868 or Form 2350 for free on eFile.com. After you have e-filed an IRS accepted tax extension, you can complete your 2022 Tax Return by October 16, 2023; all your tax extension information will be in your eFile.com account when you e-file. Virginia law requires Virginia Tax to assess interest on any balance of unpaid tax, from the due date for payment through the date the tax is paid. Interest charges apply to late payments and payments made with returns filed on extension, as well as to additional balances due with amended returns or assessed as the result of audit adjustments. To avoid paying the late payment penalty during the extension period, the tax owed must be paid when the return is filed. All corporations can file their annual income tax return and pay any tax due usingapproved software products.

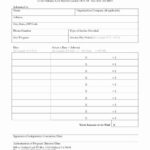

Forms & Documents

The late payment penalty is generally not assessed when an additional balance of tax is assessed as the result of an audit of an income tax return that was filed in good faith. An extension of time to file a franchise tax report will be tentatively granted upon receipt of an appropriate timely online extension payment or request on a form provided by the Comptroller. Timely means the request is received or postmarked on or before the due date of the original report. If an online extension payment is made, the taxable entity should NOT submit a paper Extension Request (Form ). Failure-to-file penalty on tax returns that are filed late if there is a refund due. However, it can be a good idea to file a tax extension anyway if you need some extra time to get your documents straightened out.

Make sure that you sign the form and check off the box indicating that you were out of the country on Tax Day before you mail it to the IRS. Be aware that any owed taxes, penalties, and interest will apply after April 18. If you have everything you need—documents, forms—to file taxes, then preparing and e-filing a tax return by Tax Day, even if you can't pay all or some of your taxes, will save you time. To avoid an extension penalty, you need to pay at least 90% of the corporation's final tax liability by the original due date for filing the return. If you file your return during the extension period, but the tax due exceeds 10% of your total tax liability, an extension penalty will apply.

Corporation Income Tax

Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings® account. H&R Block Free Online is for simple returns only. This question calls attention to a key distinction about what a tax extension is — and what it is not. An extension only gives you more time to finish the paperwork, not more time to pay. When some taxpayers ask, “How do I get an extension for my taxes?

Tax software, most providers support filing Form 4868 for tax extensions. You can simply follow the program’s instructions and see how to file a tax extension electronically that How To File An Extension For Business Taxes? way. The IRS will send you an electronic acknowledgment when you submit the form. An extension of time to file a return does not extend the date prescribed for payment of tax.

Extensions Not Allowed

If the IRS grants the extension request — it grants nearly all requests — most businesses have six months to file, until Oct. 15. The IRS does not notify you if it approves an extension request. You will receive a notice only if your extension request is denied. No matter how organized and prepared you are as a small business owner, the business tax filing due date can creep up on you.

- A domestic corporation must file a Virginia income tax return each year, even if it has no income to report.

- The original due date of the individual income tax return for calendar year taxpayers is April 15th.

- If you miss the tax extension deadline, that also means that you missed the general tax deadline.

- This automatic extension only applies to extension applications filed by a taxpayer with the Commissioner of Internal Revenue.

- Has April 15th come and gone and you have avoided filing your taxes?

- Most individual taxpayers will file their returns electronically this year.

- Rather than going through the IRS Free File system , you can just select the “extension” option when paying through the IRS payment portal.

As you learned in the previous article in our tax series, it can be tough for business owners to stay on top of all the details they’re responsible for come tax time. In this segment, we’ll clarify which forms you’ll need to file an income tax return based on your business structure. We’ll also help you file an extension if necessary, https://quick-bookkeeping.net/purchase-order-number-vs-purchase-order-item/ and select a tax prep and filing program to make the whole process so much easier than tallying your taxes by hand. You can also get an extension by electronically paying all or part of your estimated income tax due and indicating the payment is for an extension. You can make a same day payment using online account services.